Crude Oil Market Recap and Forecast

Light crude oil prices saw significant movement over the past week, with gains driven by U.S. Federal Reserve interest rate cuts and tightening supply, while demand concerns from China continued to weigh on the market.Last week, Light crude oil futures settled at $71.00, up $3.58 or +5.31%.

Oil Prices Supported by U.S. Rate Cut

Oil markets experienced a boost following the Federal Reserve’s aggressive interest rate cut of 50 basis points. This move, which exceeded expectations, is expected to stimulate economic growth by lowering borrowing costs, thus potentially increasing energy demand.

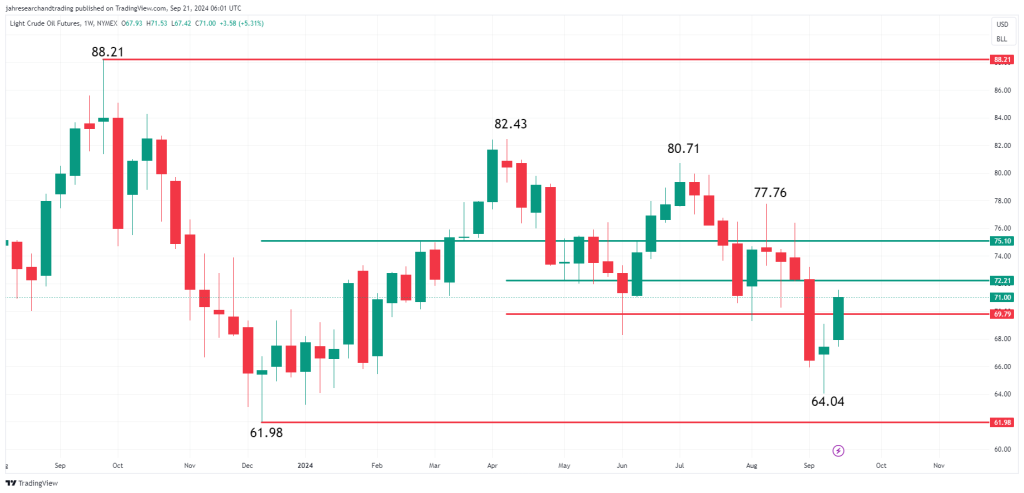

Light crude oil futures tested resistance at $69.79 to $72.21 but faced strong selling pressure, keeping prices inside this critical threshold. The market sentiment remains cautiously bullish, with further upside depending on whether oil prices can break above this resistance cluster.

U.S. Crude Supply Tightens Amid Hurricane Impact

U.S. crude inventories fell to their lowest level in a year, with stockpiles dropping by 1.6 million barrels last week. The decline was exacerbated by supply disruptions following Hurricane Francine, which reduced crude production and imports from the Gulf of Mexico. This tightening supply, coupled with the Federal Reserve’s rate cut, has helped oil prices recover from recent lows, pushing Brent and WTI up 5.31% and 4.02%, respectively, for the week.

China’s Weak Demand Limits Gains

Despite these bullish factors, China’s economic slowdown is creating a headwind for oil prices. August marked the fifth straight month of declining refinery output, highlighting weaker industrial production and consumer demand. As the world’s largest oil importer, China’s sluggish demand is capping any significant price rally. Analysts forecast a potential recovery in the fourth quarter, but the current data points to a challenging environment for crude demand.

Geopolitical Tensions in the Middle East Add Volatility

Heightened geopolitical risks in the Middle East, particularly rising tensions between Israel and Hezbollah, have further bolstered crude oil prices. Although no major supply disruptions have been reported, the possibility of an escalation keeps a risk premium on oil prices, providing additional support.

Market Forecast: Cautiously Bullish

The outlook for crude oil prices remains cautiously bullish. U.S. supply tightness, coupled with geopolitical risks, could drive prices higher, particularly if light crude manages to break through the resistance at $72.21. However, weak demand from China continues to limit the upside potential. A break below key support at $69.79 could trigger further downside toward $67.54. Traders should remain cautious, monitoring China’s economic data and U.S. inventory levels closely, as these factors will be critical in determining oil’s near-term direction.