Introduction

Gold Market Gold has long been considered a safe haven for investors, particularly during times of economic uncertainty. The yellow metal recently experienced a significant price rally, reaching record highs. However, as of late, gold has retreated sharply, echoing the swings in market sentiment and investor behavior. In this article, we will explore the reasons behind gold’s recent retreat and analyze what this shift means for investors looking for trading opportunities.

Gold Market: Understanding the Recent Rally

Gold prices surged to record levels earlier this year, driven by a combination of economic factors:

- Inflation Concerns: With inflation rates rising globally, investors flocked to gold as a hedge against currency devaluation. According to a report from the U.S. Bureau of Labor Statistics, inflation in the U.S. reached its highest levels in decades, prompting many to consider gold a safe investment.

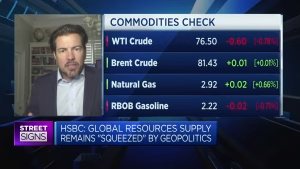

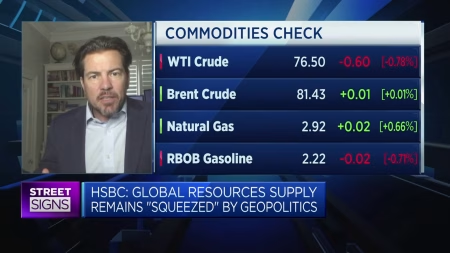

- Geopolitical Uncertainty: Ongoing geopolitical tensions, particularly stemming from conflicts in Eastern Europe and the Middle East, have historically led to increased demand for gold. According to the Center for Strategic and International Studies, uncertainties in these regions have kept investors on edge, further propelling gold prices upward.

- Weakening Dollar: A weakening U.S. dollar increases the appeal of gold for investors seeking a stable investment. As the dollar depreciates, gold becomes cheaper for foreign buyers, increasing demand and, consequently, its price.

Why Did Gold Retreat?

Despite its recent record highs, gold experienced weeks of heavy sell-offs. Here are the primary reasons behind this dramatic retreat:

- Profit-Taking: After a strong rally, many investors chose to cash in their profits. As gold prices reached historic levels, it was expected that some market corrections would follow as traders and investors aimed to secure their gains.

- Rising Interest Rates: The Federal Reserve’s signals to increase interest rates to combat inflation made gold less attractive. Higher interest rates lead investors toward yield-bearing assets rather than non-yield-bearing assets like gold. Recent commentary from Federal Reserve Chair Jerome Powell indicates a commitment to maintaining this trajectory, impacting gold pricing. (Source: Federal Reserve Newsroom)

- Strengthening Dollar: After a period of weakness, the dollar started to appreciate, leading to further declines in gold prices. This inverse relationship between the dollar and gold has been well-documented, with historical data showing that fluctuations in the dollar value often correspond to similar movements in gold prices.

Market Sentiment: Technical Analysis

Technical indicators also play a crucial role in understanding price movements:

- Support and Resistance Levels: Various analysts monitor specific technical levels to gauge market behavior. For example, if gold initially rallied past $2,000 per ounce, the $1,900 level might serve as a significant support line. Traders often watch these lines carefully to make informed trading decisions.

- Moving Averages: The 50-day and 200-day moving averages are commonly used to identify trends. A crossover, or when a shorter-term moving average moves above a longer-term moving average, can indicate bullish trends—while the opposite is true for bearish trends.

Gold Market Retreat

What Lies Ahead for Investors?

While the retreat in gold prices may seem alarming, it is important to take a more nuanced view of the situation. Here are some key considerations going forward:

- Long-Term Hedging Strategy: Investors looking for long-term stability may still find value in including gold as part of a diversified portfolio. Gold traditionally performs well during economic downturns, as observed in past financial crises.

- Market Volatility: This retreat could present an opportunity for traders to buy the dip. Market volatility often creates openings for savvy investors willing to analyze risk-reward ratios.

- Emerging Economic Indicators: Keeping an eye on economic indicators such as employment figures, inflation reports, and GDP growth will help forecast the gold market’s trajectory. Websites like Trading Economics provide up-to-date information on these economic indicators.

Conclusion

The recent retreat in gold prices, after a remarkable rally, reflects the complexities of the current economic landscape. Factors such as profit-taking, rising interest rates, and fluctuating dollar value have all contributed to this shift. However, the fundamentals of gold as a store of value and a hedge against economic instability remain strong.

For investors, the golden question is not just about short-term movements but understanding the broader economic context and positioning themselves for future opportunities. With the right analysis and a well-structured strategy, you can navigate these market changes effectively.