MT4 Indicators – When it comes to online trading, the right tools can make all the difference. One such vital tool used by traders across the globe is the MT4 indicators. These indicators provide essential insights into market trends, enabling traders to make informed decisions. Whether you are a novice or an experienced trader, understanding and applying MT4 indicators can significantly enhance your trading strategy. In this article, we will explore what MT4 indicators are, their types, popular indicators, and how to effectively use them in your trading.

What are MT4 Indicators?

MT4 indicators are analytical tools integrated into the MetaTrader 4 (MT4) trading platform. They are used to analyze price movements and forecast future market trends. Traders utilize these indicators to uncover patterns and signals that can indicate potential buying or selling opportunities.

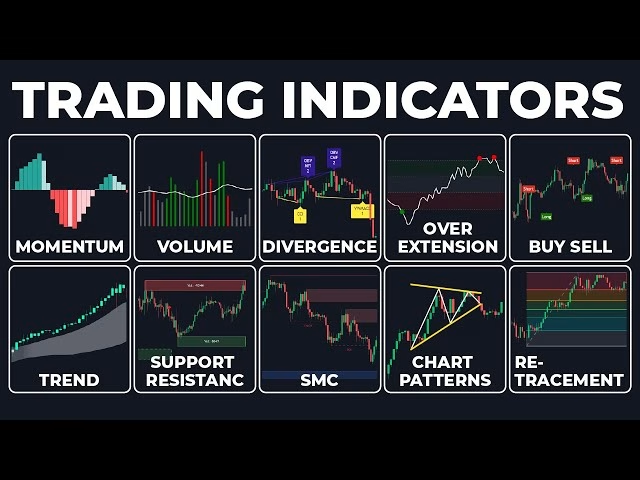

MT4 indicators can be categorized into three main types:

- Trend Indicators: These indicators help determine the direction of the market trend—whether it is upward, downward, or sideways.

- Oscillators: These indicators measure the momentum of price movements within a specific range, allowing traders to identify overbought or oversold conditions.

- Volume Indicators: These indicators analyze the trading volume and help traders understand the strength behind price movements.

Why Use MT4 Indicators?

Using MT4 indicators offers several advantages for traders:

- Data Visualization: Indicators provide clear visual representations of market trends, making it easier for traders to analyze data quickly.

- Enhanced Decision Making: By using indicators, traders can make more informed decisions based on quantifiable data rather than emotions.

- Trend Identification: Indicators help identify whether a market is trending or ranging, helping traders adjust their strategies accordingly.

- Backtesting: MT4 allows traders to backtest indicators using historical data, helping them refine their strategies before implementing them in live markets.

Mt4 indicators

Popular MT4 Indicators and Their Applications

Understanding which indicators to use can significantly improve your trading success. Below are some of the most popular MT4 indicators and how to use them effectively:

1. Moving Average (MA)

The Moving Average is a trend-following indicator that smoothes price data to identify the direction of the trend. Traders typically use two types of moving averages:

- Simple Moving Average (SMA): Calculates the average of the closing prices over a specified time period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to new information.

Usage: Traders use MAs to identify trend direction, generate buy/sell signals, and identify support and resistance levels.

2. Relative Strength Index (RSI)

The RSI is a popular momentum oscillator that measures the speed and change of price movements, typically ranging between 0 and 100. An RSI reading above 70 indicates overbought conditions, while a reading below 30 suggests oversold conditions.

Usage: Traders employ the RSI to identify potential reversal points, divergence with price movements, and overall market momentum.

3. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands that represent standard deviations from the SMA. This indicator helps traders assess volatility and potential price reversals.

Usage: When the price touches the upper band, it may indicate overbought conditions, while touching the lower band may suggest oversold conditions.

4. MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of the MACD line, signal line, and histogram.

Usage: Traders use MACD to identify bullish or bearish momentum, potential reversal points, and generate buy/sell signals based on crossovers.

5. Stochastic Oscillator

The Stochastic Oscillator compares a particular closing price to a range of prices over a specific period. The resulting value is expressed as a percentage, indicating whether an asset is overbought or oversold.

Usage: A reading above 80 indicates an overbought market, while a reading below 20 indicates an oversold market. Traders often look for divergences and crossovers to generate signals.

How to Set Up MT4 Indicators

Setting up indicators in MT4 is a straightforward process. Here are the steps:

- Open MT4 Platform: Launch your MT4 trading platform and select the chart you wish to analyze.

- Insert Indicator: Click on the “Insert” menu at the top, then choose “Indicators.” A dropdown will appear with various categories.

- Select Your Indicator: Navigate through the categories to find your desired indicator. Click on it, and a settings window will appear.

- Adjust Settings: Customize the settings as needed (e.g., period lengths or colors), and click “OK.”

- Analyze the Chart: After clicking OK, the selected indicator will appear on your chart. You can now begin your analysis.

Tips for Using MT4 Indicators Effectively

- Combine Indicators Wisely: Using multiple indicators can enhance your strategy, but avoid cluttering your chart. Focus on combining indicators that provide different types of information.

- Backtest Your Strategy: Before trading live, backtest your chosen indicators using historical data to see how they perform under various market conditions.

- Understand Signal Limitations: No indicator is foolproof. Be aware of false signals and use additional confirmation methods, such as price action analysis or candlestick patterns.

- Stay Updated with Market News: Economic news and events can significantly impact indicator performance. Regularly check economic calendars and news events to avoid potential pitfalls.

Resources for Further Learning

For traders looking to enhance their understanding of MT4 indicators and trading strategies, consider exploring these resources:

- Investopedia: Technical Indicators

- BabyPips: Trading with Indicators

- DailyFX: How to Use MT4 Indicators

Relevant Outgoing Links

Internal Links

In conclusion, MT4 indicators play a crucial role in developing a successful trading strategy. By understanding different types of indicators, their applications, and effective usage, traders can gain valuable insights into market behavior. For further resources and support on your trading journey, don’t forget to explore Trading Market Signals, where we offer extensive information and tools to empower your trading decisions.

By providing comprehensive information and relevant resources, this article is designed to optimize search engine visibility and aid in understanding MT4 indicators effectively. If there are any specific changes or additional information you’d like to include, feel free to ask!