Commodities News – In the vast world of financial markets, commodities play a crucial role, serving as fundamental building blocks for both economies and portfolios. Commodities are raw materials or primary agricultural products that can be bought and sold, often used in manufacturing and production processes. Understanding how commodities function is vital for investors and traders alike. In this article, we will delve into what commodities are, the types available, how to invest in them, and insights into market dynamics.

What Are Commodities News?

Commodities are classified into two main categories: hard commodities and soft commodities.

- Hard Commodities: These are natural resources that are mined or extracted. Metals like gold, silver, and copper, as well as energy resources like oil and natural gas, fall into this category.

- Soft Commodities: These are agricultural products or livestock. Common examples include corn, soybeans, wheat, sugar, coffee, and orange juice.

Trading in commodities typically occurs on various exchanges, including the Chicago Mercantile Exchange (CME), the London Metal Exchange (LME), and the Intercontinental Exchange (ICE).

The Importance of Commodities in the Global Economy

The significance of commodities in the worldwide economy cannot be overstated. They influence inflation, employment rates, and even currency values. Commodities are often seen as a hedge against inflation. When the prices of goods rise, commodities tend to increase in value as well.

Investing in commodities can offer diversification to a portfolio. Unlike stocks and bonds that may move in the same direction during a market downturn, commodities may behave differently. This characteristic can provide investors with a safety buffer against market fluctuations.

How to Invest in Commodities

Investors have a variety of options when it comes to investing in commodities. Here are some popular methods:

1. Commodity Futures

Futures contracts are agreements to buy or sell an asset at a predetermined future date and price. These contracts are standardized and traded on exchanges. Investing in commodity futures can be risky due to price volatility but can offer significant returns.

2. Exchange-Traded Funds (ETFs)

Commodities ETFs track the price of a commodity or a basket of commodities. They provide a way for investors to gain exposure without directly trading in futures. The SPDR Gold Shares (GLD) and iPath Series B Bloomberg Commodity Index Total Return ETN (DJP) are examples of popular commodity ETFs.

3. Mutual Funds

Some mutual funds focus on commodities, allowing investors to gain exposure without needing to trade futures themselves. These funds invest in companies involved in the commodity production process.

4. Physical Commodities

Some investors choose to purchase physical commodities, such as gold or silver bullion. While this method allows for tangible ownership, it comes with storage and security considerations.

Market Dynamics: Factors Influencing Commodity Prices

Several variables can influence commodity prices, creating a dynamic and sometimes unpredictable market.

1. Supply and Demand

The fundamental principle of supply and demand significantly affects commodity prices. When demand increases or supply decreases, prices typically rise. Conversely, when supply increases or demand falls, prices may decline.

2. Economic Indicators

Economic indicators such as GDP growth, inflation rates, and employment reports can impact commodity prices. For instance, a growing economy may increase demand for energy (oil, gas) and industrial metals (copper, aluminum).

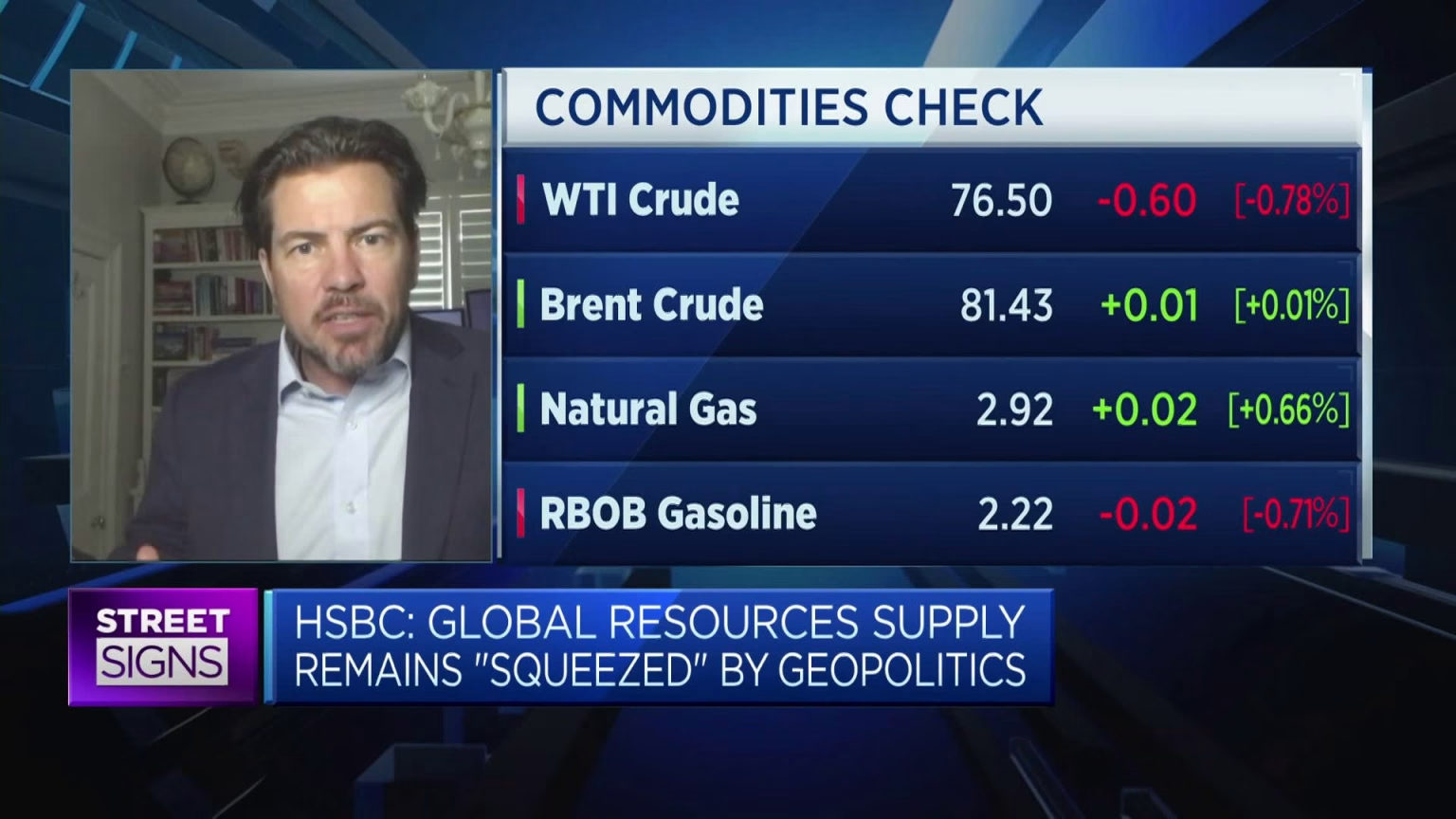

3. Geopolitical Factors

Geopolitical tensions can lead to fluctuations in commodity prices. Natural disasters, trade policies, and political instability in oil-producing regions can create supply concerns, impacting prices.

4. Currency Strength

Commodities are generally priced in US dollars; therefore, the strength of the dollar can influence prices. A stronger dollar may lead to lower commodity prices, while a weaker dollar can have the opposite effect.

Strategies for Commodity Trading

Investing in commodities can be profitable, but it requires strategic planning and insight into market trends. Here are essential strategies:

1. Diversification

Spreading investments across different types of commodities can reduce risk. This approach allows investors to offset losses in one area with gains in another.

2. Technical Analysis

Technical analysis can be useful in commodity trading. By studying charts and historical price movements, traders can identify potential entry and exit points.

3. Keeping Up with Market News

Staying updated on news from sources like the U.S. Energy Information Administration (EIA) or trading platforms like Trading Market Signals can provide insights that help forecast price movements.

4. Using Stop-Loss Orders

To mitigate potential losses, traders can set stop-loss orders, which automatically sell a position at a predetermined price.

Challenges in Commodity Trading

While trading commodities can be lucrative, it also comes with challenges. Market volatility can lead to rapid price fluctuations, requiring traders to remain vigilant. Additionally, understanding the complexities of the commodities market can be daunting for newcomers.

Conclusion

In summary, commodities are a vital component of the global economy, offering opportunities for investment, diversification, and hedging against inflation. By understanding the various types of commodities, their market dynamics, and effective trading strategies, investors can make informed decisions. As with any investment, it’s important to approach commodities with caution, conduct thorough research, and stay informed about market conditions.

Further Reading

For more information on trading and investment strategies, consider checking out these valuable resources:

Understanding commodities is essential for any investor looking to enhance their portfolio with diversified assets. As you navigate this exhilarating market, rely on reputable sources and stay educated to harness the potential of commodity trading effectively.