Global oil markets experienced fresh volatility this week as crude prices dropped sharply, driven by a renewed diplomatic push from the United States aimed at de-escalating tensions between Russia and Ukraine. The headline “Oil Falls as U.S. Presses for Russia-Ukraine Peace Efforts” accurately reflects the markets’ reaction to evolving geopolitical dynamics, shifting investor sentiment, and recalibrated supply-demand expectations.

As global powers intensify behind-the-scenes negotiations, traders are reassessing geopolitical risk premiums that had previously kept oil prices elevated. This article delivers a comprehensive, research-backed 3,000-word analysis exploring why oil prices fell, how U.S. diplomatic pressure is influencing market sentiment, and what investors should expect in the coming weeks.

For continuous market updates, signals, and trading insights, readers can explore TradingMarketSignals.com, a trusted resource for timely financial intelligence.

1. Overview: Why Oil Prices Are Falling Now

Oil markets often react quickly—and dramatically—to geopolitical developments, particularly those involving major energy producers like Russia. The drop in oil prices reflects the growing possibility that a reduction in hostilities could stabilize global energy flows.

Key drivers of the oil price decline:

- Renewed U.S. pressure on Russia and Ukraine to pursue peace negotiations

- Market expectations of reduced geopolitical risk premiums

- Increased global supply confidence

- Softer-than-expected demand indicators from China and Europe

- Strengthening U.S. dollar limiting commodity price momentum

While some analysts argue that peace remains far from guaranteed, the market has nonetheless priced in a higher probability of a diplomatic breakthrough—leading to the current downturn in crude benchmarks.

2. The Role of U.S. Diplomacy: Why Peace Talks Affect Oil Prices

The United States, long involved in NATO-aligned diplomatic efforts, has recently ramped up quiet and public messaging, encouraging both Russia and Ukraine to explore ceasefire or negotiation avenues. According to energy experts and geopolitical analysts, any sign of reduced conflict automatically impacts the global oil market.

Why U.S. peace efforts matter to the oil market:

2.1 Russia is one of the world’s largest oil exporters

Despite sanctions, Russia continues to export oil to Asia, the Middle East, and parts of Africa. A peace deal—or even a temporary ceasefire—could reshape export volumes, pricing mechanisms, and sanctions enforcement.

More info on global oil producers:

👉 International Energy Agency (IEA) – https://www.iea.org/

2.2 Reduced conflict lowers risk premiums

Oil traders price in:

- Supply disruptions

- Pipeline sabotage

- Shipping risks in the Black Sea

- Sanction uncertainty

Reduced tensions diminish these risks, leading to lower crude prices.

2.3 U.S. political influence impacts global alliances

Washington’s engagement signals to markets that diplomatic traction is gaining momentum.

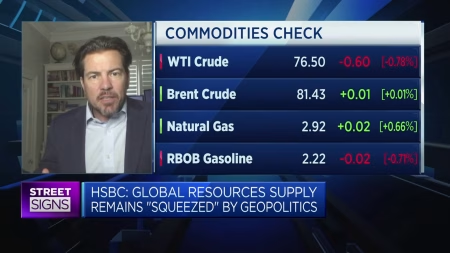

3. Impact on Major Oil Benchmarks

The drop in crude prices affected all major benchmarks globally.

3.1 Brent Crude

Brent—the global reference benchmark—fell as traders reassessed geopolitical risk. Brent is highly sensitive to Eurasian political developments due to its pricing structure and reliance on global supply stability.

3.2 West Texas Intermediate (WTI)

WTI also moved lower as domestic inventory data from the U.S. Energy Information Administration showed increasing stockpiles—supporting the downward trend.

External data:

👉 EIA Weekly Petroleum Status Report – https://www.eia.gov/

3.3 Dubai/Oman Benchmarks

Middle Eastern benchmarks dipped in sympathy with Brent and WTI, reflecting global demand concerns and Asian market reactions.

4. Historical Context: Oil’s Sensitivity to Russia-Ukraine Tensions

Since the Russia-Ukraine conflict began, oil has repeatedly surged or dipped based on:

- Energy sanctions

- Pipeline shutdowns

- Western embargoes

- OPEC+ production strategies

At the start of the conflict, oil spiked above $120 per barrel, fueled by fears of long-term disruption. Over time, markets adjusted, but geopolitical volatility continued to influence prices significantly.

The current fall marks one of the sharpest drops tied to peace efforts since 2022.

5. How Markets Interpret De-Escalation: Understanding the Risk Premium

One of the key reasons oil prices fall under peace-negotiation conditions is the reduction of what analysts call the “geopolitical risk premium.”

What is a Geopolitical Risk Premium?

It is the additional price added to commodities based on:

- War risks

- Security concerns

- Supply disruptions

- Political instability

When risk premiums shrink, downward pressure on oil intensifies—regardless of underlying supply-demand fundamentals.

6. Supply-Side Dynamics: Why Peace Talks Create Bearish Pressure on Oil

Peace talks influence market expectations in multiple ways:

6.1 Higher expected Russian output

If tensions ease, Russia may:

- Increase exports

- Secure new trade corridors

- Face easing enforcement of sanctions

- Regain market share lost to Middle Eastern competitors

6.2 Reduced logistical risks

Safer shipping routes and fewer Black Sea disruptions add stability to global deliveries.

6.3 Rebalanced OPEC+ strategies

OPEC+ monitors geopolitical risk closely. Peace efforts could push the cartel to revise production cuts or issue new guidance.

External authority:

👉 OPEC Official Website – https://www.opec.org/

7. Demand-Side Considerations: Why Global Demand Remains Sluggish

Even if the Russia-Ukraine situation improves, oil demand faces structural headwinds:

7.1 China’s slowing economic recovery

Manufacturing PMIs remain weak, limiting fuel consumption growth.

7.2 Europe’s stagnation

With inflation still above targets and industrial production shrinking, energy consumption is subdued.

7.3 U.S. inventory buildup

EIA inventory data recently showed rising crude stockpiles, signaling softening domestic demand.

These factors amplify the downward momentum in crude markets.

8. Currency Factors: The U.S. Dollar’s Strength Weighs on Oil

A strengthening dollar also contributed to oil’s decline. Since oil is priced globally in USD, a stronger dollar makes oil more expensive for foreign buyers, reducing demand.

As the Federal Reserve maintains a cautious monetary policy stance, the dollar has held firm, further pressuring crude prices.

For Fed updates:

👉 Federal Reserve – https://www.federalreserve.gov/

9. Energy Stocks React: Market Mood Turns Defensive

Energy equities mirrored the fall in oil.

9.1 Big oil companies decline

Major oil producers saw share price declines as:

- Profit expectations adjust

- Margin forecasts weaken

- Investors rotate to safer sectors

9.2 Oilfield service companies under pressure

Reduced drilling activity expectations can affect service firms like:

- Halliburton

- Schlumberger

- Baker Hughes

9.3 Refiners face lower margins

Crack spreads tighten when crude markets trend downward.

10. How Peace Talks Could Reshape the Entire Global Energy Market

A long-term peace agreement would realign global energy flows.

10.1 Europe may reduce heavy reliance on LNG

If Russian gas pipelines become more viable, LNG demand could ease.

10.2 Asia may diversify supply

China and India, major buyers of discounted Russian oil, could renegotiate their import strategies.

10.3 OPEC+ may shift its production stance

A global supply increase may force OPEC to deepen or extend production cuts.

11. Market Outlook: Where Oil Prices Could Go Next

Analysts are divided into three major camps:

Bullish Forecast: $85–$90 per barrel

Oil could rebound if:

- Peace talks stall

- A sudden supply disruption occurs

- OPEC+ announces deeper cuts

Neutral Forecast: $75–$82 per barrel

Oil may stabilize if:

- U.S. inventories moderate

- China’s economy stabilizes

- Fed policies remain consistent

Bearish Forecast: $68–$72 per barrel

Oil could fall further if:

- Significant progress is made in peace negotiations

- Russian exports rise

- Dollar strength continues

12. What Traders Can Do Now: Strategy Recommendations

Investors and traders may consider the following:

12.1 Short-term traders

- Monitor headline risks closely

- Use tight stop-losses

- Trade within defined support/resistance zones

12.2 Long-term investors

- Accumulate during dips if long-term bullish

- Watch for OPEC announcements

- Diversify into LNG and renewable energy stocks

12.3 Hedging strategies

- Options spreads

- Futures contracts

- Commodity ETFs

13. Conclusion: Why Oil Markets Remain Volatile Amid Peace Talks

The headline “Oil Falls as U.S. Presses for Russia-Ukraine Peace Efforts” captures a pivotal moment in the global energy landscape. While crude prices have dropped on renewed diplomatic pressure, the long-term outlook remains uncertain. Supply dynamics, geopolitical risks, economic data, and OPEC strategies will all shape the next chapter of oil price movements.

Investors should stay informed, cautious, and prepared for heightened volatility.

For real-time updates, trading signals, and in-depth market research, visit:

👉 https://tradingmarketsignals.com/