Israel-Hamas Conflict, The prolonged conflict between Israel and Hamas has had profound implications not only for the Middle East but also for global financial markets. Over the last two years, as tensions have escalated and military actions have intensified, investors have been closely monitoring the markets for any signs of significant shifts. This article delves into the responses of various global financial markets to the conflict, examining stock indices, commodities, and economic outlooks, while providing insights on trading strategies during geopolitical turbulence.

Understanding The Israel-Hamas Conflict

The Israel-Hamas conflict, which reignited with fervor in recent years, has its roots in historical tensions over territorial disputes, governance, and socio-political relations in the region. This ongoing war has not only resulted in humanitarian crises but has also reverberated throughout the global economy, affecting trade routes, energy prices, and investment sentiment worldwide.

Initial Market Reactions

The conflict’s re-escalation in 2023 saw immediate reactions in global financial markets. As news broke of escalations, markets reacted swiftly, with declines in stock prices across major indices. The uncertainty surrounding military actions often leads to risk aversion among investors, prompting them to pull out of equity markets in favor of safer assets.

Key Indicators of Market Response

- Stock Market Volatility: Major indices such as the S&P 500, FTSE 100, and Nikkei experienced heightened volatility. Historical data indicates that geopolitical events often lead to short-term market dips as traders react to the evolving situation.

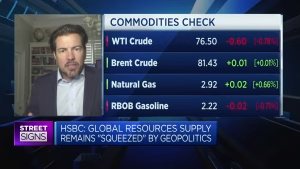

- Commodity Prices: An immediate impact was observed in the prices of oil and gold. Investors commonly turn to gold as a safe-haven asset during conflicts, pushing its prices higher. Conversely, oil prices reacted to concerns over supply disruptions in the Middle East, given the region’s critical role in global oil supply.

- Currency Fluctuations: The U.S. Dollar often strengthens during geopolitical turmoil, operating as a safe-haven currency. Meanwhile, currencies of nations more directly affected by the conflict displayed increased volatility.

Source: World Bank – Provides insights on global economic stability affected by geopolitical events.

Long-term Implications on Financial Markets

As the conflict continued into 2024, traders and analysts began to assess the medium- and long-term implications for global financial markets. The initial panics gave way to a complex array of market responses as investors adapted to the ongoing situation.

1. Sector-Specific Impacts

Certain sectors were more acutely affected by the conflict than others:

- Defense Stocks: Manufacturers of defense weapons and technology saw a surge in stock prices as governments increased military expenditures.

- Energy Sector: Companies engaged in oil and gas exploration experienced fluctuating stock prices, tied closely to ongoing conflicts and OPEC decisions.

- Travel and Tourism: The travel industry encountered setbacks as geopolitical instability deterred potential tourists from visiting affected regions.

Source: Bloomberg – For comprehensive market analysis on sector performance.

2. Investment Trends

With uncertainty regarding the conflict, many investors began diversifying their portfolios. Investments in emerging markets, particularly those in Africa and Asia with less exposure to the conflict, gained traction as a strategy to mitigate risk.

Source: MSCI – Offers insights into global investing and market trends.

Economic Forecasts Amidst Conflict

Analysts have worked to gauge the longer-term economic impacts of the Israel-Hamas conflict. With both the global economy and regional economies feeling the strain, there have been forecasts of potential recessions, particularly if the conflict escalates further.

1. Global Growth Projections

The International Monetary Fund (IMF) has noted adjustments to growth projections for countries heavily impacted by the conflict. Reduced foreign investments and security challenges have raised concerns over sustained economic development.

Source: IMF – For updated economic forecasts and policy discussions.

2. Trade Disruptions

Disruptions in trade routes, particularly in the Mediterranean, have raised shipping costs and created bottlenecks affecting global supply chains. As a result, inflationary pressures have mounted across countries reliant on imports, impacting consumer prices worldwide.

Trading Strategies in Response to Geopolitical Tensions

Given the market volatility triggered by the Israel-Hamas conflict, traders have adopted various strategies to navigate through uncertainty:

- Hedging: Investors are increasingly using options and futures contracts to hedge against potential declines in stock prices, as well as to protect against commodity price fluctuations.

- Short Selling: Some traders have utilized short-selling strategies against sectors that are negatively impacted by the conflict.

- Diversification: Expanding investment horizons to include international markets not directly affected by the conflict can spread risk and reduce volatility exposure.

The Role of Technology and Information

The rise of digital trading platforms and real-time information has transformed how traders and investors respond to global events. Social media, news platforms, and trading apps facilitate immediate reactions to breaking news, shaping market responses more rapidly than ever before.

Source: MarketWatch – Provides real-time market updates and analysis.

Conclusion

The response of global financial markets to the ongoing Israel-Hamas conflict over the last two years underscores the intricate relationship between geopolitical events and economic performance. As history has shown, military conflicts can lead to significant market volatility, impacting everything from stock prices to commodity values.

Moving forward, investors must remain vigilant, adopting adaptive strategies to navigate the uncertain waters shaped by geopolitical conflicts. Understanding the interplay between such conflicts and market dynamics is essential for making informed investment decisions in an increasingly interconnected world.

External Links

- Trading Economics: Economic Indicators and Forecasts

- Reuters: Financial Market News and Analysis

- Yahoo Finance: Market Data and News

Internal Links

- Trading Market Signals: Market Analysis and Predictions

- Trading Market Signals Blog: Geopolitical Risks and Trading

This article aims to provide a thorough exploration of how the global financial markets respond to ongoing conflicts, specifically the situation between Israel and Hamas, ensuring it is indexed effectively for visibility in Google search results through the use of SEO strategies.